In his Autumn Statement the Chancellor, George Osborne, reformed stamp duty on home purchases, which will be more along the lines of the system due to be introduced in Scotland. The changes came into effect midnight 3rd December. But, what do these changes mean? And how do they work?

The chancellor said that the current system, where the amount owed jumps at certain

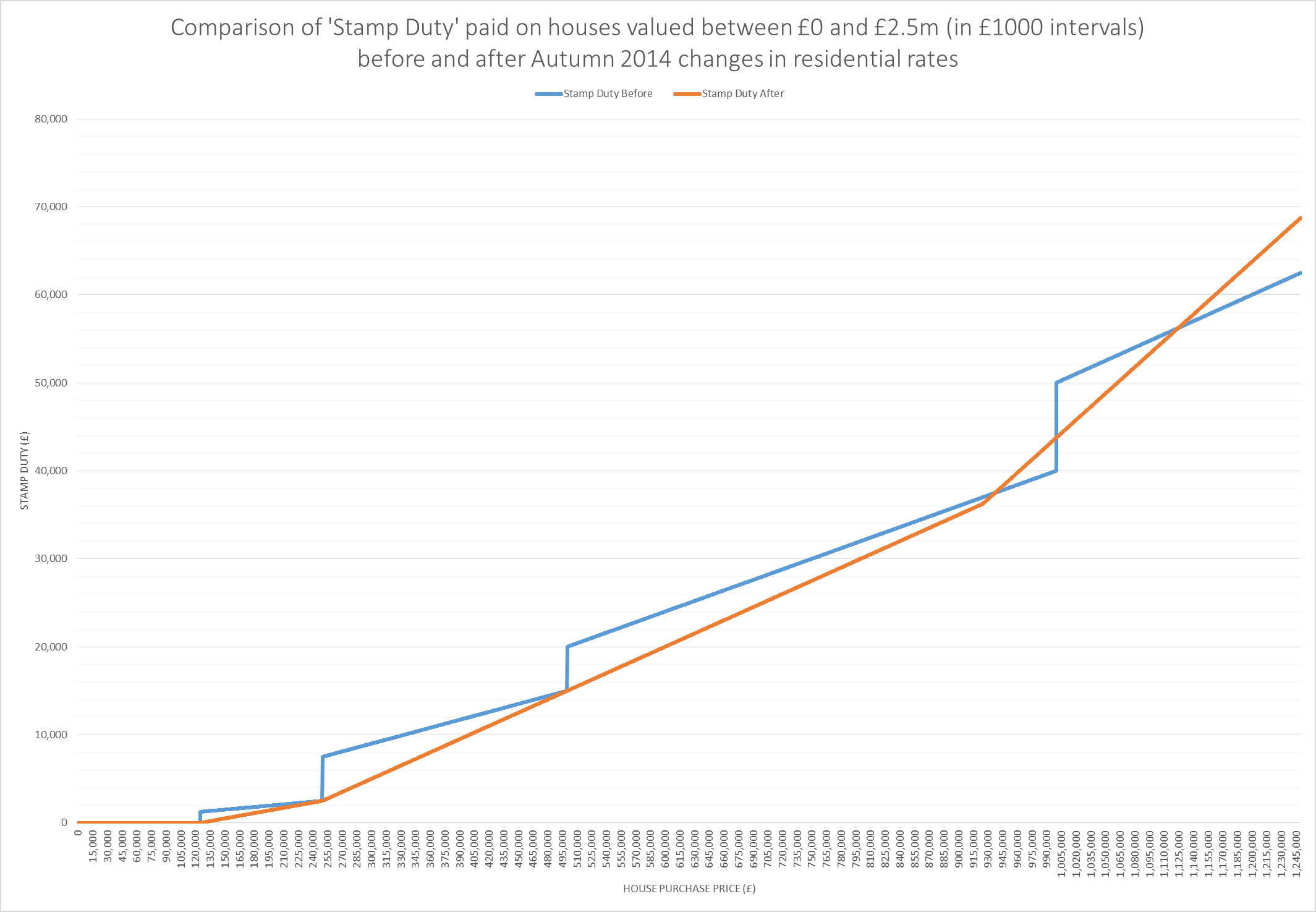

price levels, would be replaced by a graduated rate, working in a similar way to income tax. He also commented that 98% of homeowners in England and Wales would pay less after the changes than they do under the current system and only people who buy homes worth more than £937,000 will pay more in tax.

“It’s time we changed this badly-designed tax on aspiration,” Mr Osborne told MPs.

Stamp duty before the changes, which operates throughout the UK, charges successively higher rates on the whole of the purchase price. For this reason it is often criticised as a “slab tax”. Its structure means there are sudden increases in stamp duty, when the price goes above the next threshold.

This can be noted by the sharp increases in stamp duty as house prices rise on the graph below.

For example, someone buying a home for £250,000 would currently pay £2,500, or 1%, in stamp duty. But if the price was £1 more, they would pay an extra £5,000, as they then pay 3% on the whole purchase price.

After 3rd December, new rates of stamp duty will only apply to the amount of the purchase price that falls within the particular duty band.

In other words, someone buying a house for £200,000 will pay nothing on the first £125,000, and then 2% of the next £75,000, giving them a bill of £1,500. Previously they would have paid 1% on the total purchase price, giving them a bill of £2,000.

This can be noted by a smoother increasing line, depicting stamp duty, as house prices rise on the graph below.

However, this change does not always mean a decreasing tax liability. Most purchases between £125,000 and £937,500 will be better off under the new system. However, house prices between £937,500 and £1m, as well as prices greater than £1.125m will be worse off than before.

Stamp Duty comparison by Stack & Jones Ltd. (click to zoom)

For more information please see the original articles via these hyper-links:

http://www.bbc.co.uk/news/business-30309468

http://www.bbc.co.uk/news/uk-politics-30313663

http://www.bbc.co.uk/news/uk-politics-30291460